Trade

Facility

14%

p.a.

Paid MONTHLY

Development

Fund

12%

p.a.

Paid MONTHLY

60%

Faster

construction

times

30%

More

cost

efficiencies

15%

Less

wastage

Disruption is reshaping the world's Largest ecosystem

Centurion Capital investment options all share the common goal of providing income-focused solutions designed to help you achieve your financial goals, future proof your income, and finally potentially LOSE some of that fear of “outliving your money” in Retirement

Now Accepting Investors

**Limited availability

This Reg A+ offering is brought to you by Digital Offering, a FINRA registered broker-dealer, and presented on equifund.com by Equifund, LLC.

OFFERING TYPE

Regulation A+

PRICE PER UNIT

$1.25

(each unit includes: 1 share + 1 warrant @ $2.50)

VALUATION

$37.5 million

MINIMUM

500

For wholesale and sophisticated investors looking for a way to diversify from underperforming Traditional investments, and share in a mission to build Faster, Smarter, and more Sustainable Buildings Affordable For Everyone

.

.

.

⌄

'the answer is in our Our proprietary Pre-fabrication modular technology called...'

“ARBT Pre-Fab System”

Keep reading to learn more about a rare Triple bottom line investment opportunity instilling

Environmental, Social , AND Corporate Governance.

The Investment philosophy asserts Three guiding concepts, known as the “Triple bottom Line”:

1.Highly Profitable

Our returns are based on sharing the development profits with the fund, whilst insulating it from most of the risks.

2. Positive Environmental Impact

Our prefabrication technology delivers best of breed environmental outcomes with a minimum of 52% less waste and 55% more efficient than traditional building methods.

3. Improves Community Living Standards

We give people flexibility with a long term solution to having a place to live who may not want to buy a home. Additionally, we have dedicated a significant number of our apartments to affordable living.

that has the potential to...

∎ Disrupt and Re-shape The world’s Largest ecosystem….

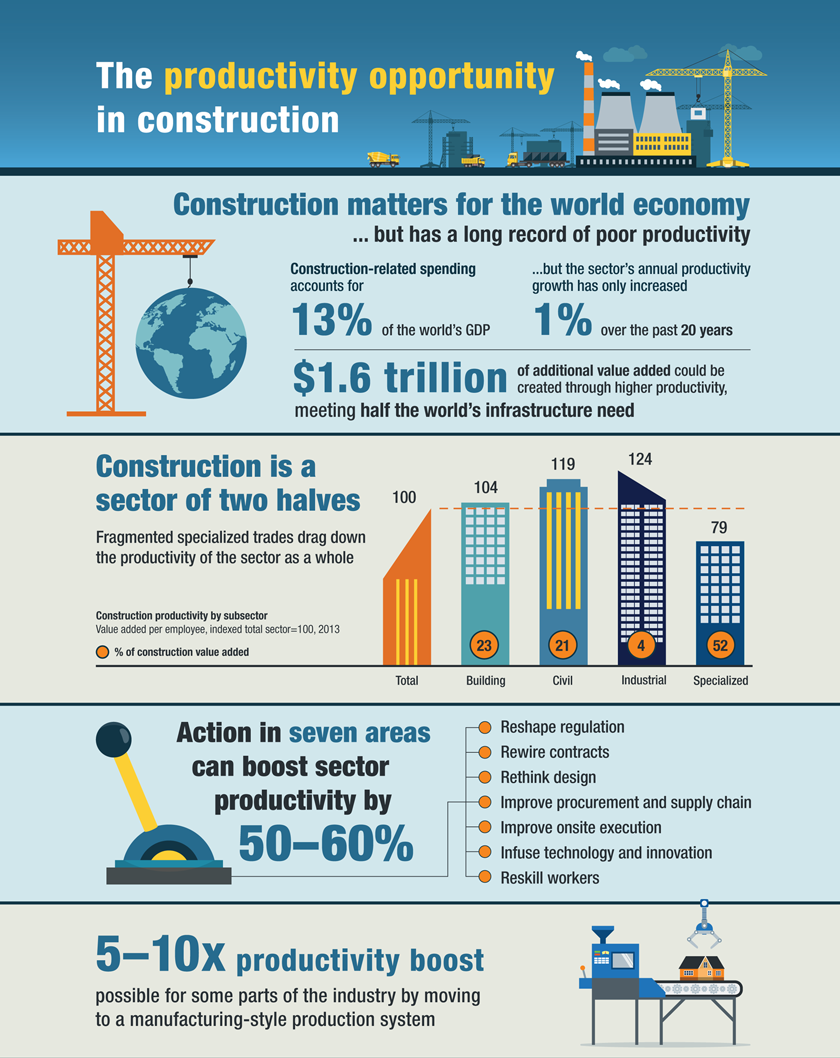

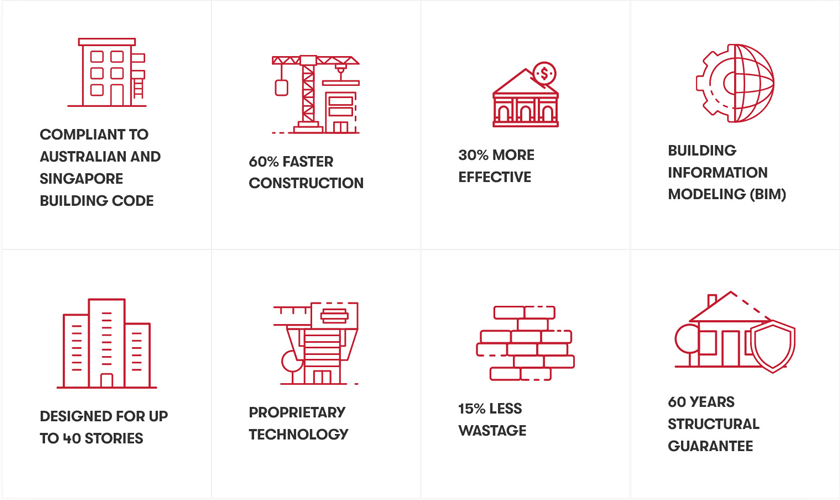

∎ Result in 60% faster construction times, 30% more cost efficiencies, and 15% less wastage…

∎ Allow us to work with much higher profit margins that can be passed onto Investors in the form of higher 12 - 14% p.a Returns, Paid Monthly.......GUARANTEED!

∎ Improve housing productivity, safety and affordability using off-site construction methodology combined with advanced manufacturing technology, incorporating the most cutting edge expertise in Robotics, AI & 3D Printing.

∎ And help everyday investors get a piece of the $24 Trillion dollar combined construction & alternative Investment industry, as the world races towards solving Housing Affordability on a Global scale by producing “Faster,Smarter, More Sustainable Buildings” at scale, affordable to Everyone!

Want To Invest In This Company?

Click the button below to get started...

The “Big Idea” In 60 Seconds

Thanks to a strange combination of events, a digital technology transformation & trend encompassing the very best off-site construction methodology combined with the most advanced cutting edge manufacturing digital technologies, addressing and solving the “Housing Affordability” problem, One building at a time, by addressing the real core of this problem - the cost and productivity inefficiencies, the construction industry has been experiencing for far too long. Combine this with the huge rise in the “Alternative Investment” industry, freeing up the opportunity for the everyday investor to get into a game, that was once reserved solely for the high net worth Institutional Investor, well….not any more, Now you get to be part of this $24 trillion dollar combined (approx) global phenomenon.

For decades, alternative investments were not readily available to the average investor. Instead, they were reserved for institutional investors and high net-worth individuals …….Until Now! Alternatives are now an essential component of everyday investment portfolios. Global Alternative investments under management have risen from $7.9 trillion in 2013 to over $10 trillion in 2020. The volume is expected to reach $14 trillion by 2023

.And as if that wasn’t enough, according to IBIS World, the size of the Construction industry in just Australia alone is $424.1 Billion in 2022, & the construction sector is one of the largest in the world economy, with about $10 trillion spent on construction-related goods and services every year. However, the industry’s productivity has lagged behind, & trailed that of other sectors for decades, (up until now), and there is a $1.6 trillion “opportunity” to close the gap

And now, for the first time in history, we are solving the “housing affordability” problem by building faster, smarter and more sustainable buildings.

Solomon Noel (CEO & Founder - ARBT Prefab) says it best here...

"To solve the housing affordability on a global scale: We believe by combining technology in design and by adding the advanced automation technology like Robotics and 3D Printing to the manufacturing techniques can produce a scalable product; executed through a fully integrated supply chain."

(Solomon Noel | Founder & CEO | www.arbtprefab.com)

This will lead to cost efficiencies which can be reinvested to produce a better and an affordable quality product by continuously improving the process.

ARBT – short for Australian Robotic Building Technology – has officially arrived!

For investors who are looking for a unique way to get in at the beginning of on one of the hottest trends in the Construction industry, solving the biggest problems such as cost inefficiencies, resulting in razor thin margins, labor shortages, building more “environmentally friendly” sustainable buildings... in a nutshell, significantly improving Productivity. To give some perspective, A 5-10x Productivity Boost by moving to a manufacturing style technology based production system, is very realistic, which in dollar terms, equates to $1.6 TRILLION of additional value added, and could simply be created through higher productivity, meeting half the world's infrastructure needs. Centurion Trade Facility and Development Fund - these two funds are a rare triple-bottom-line investment opportunity that has the potential to create significant tangible financial returns and cashflow — along with positive social and environmental impact.

The company likely will not require endless government subsidies to reach profitability

Thanks to their patent protected technology, they’re able to offer a high quality product that performs better than using other materials, at a competitive (or cheaper) price...

Their solution is already in the market and have a very sold track record, and proof of concept

We have proved in the last 8 years that we can manufacture and construct buildings of exceptional quality and consistency, built off-site in a controlled manufacturing environment and then installed on-site.

And the Centurion team is currently in negotiations with several other local and state governments about implementing this breakthrough technology (of course, there’s no guarantee these contracts will come to pass).

Insiders have “skin in the game” with plans to invest more

None of the executive officers have taken a salary to date, and many of them plan on investing more of their own money into this round, alongside “the crowd.”

The ARBT Property Group (APG) has entered into development agreement with the land owner to develop the site into a upscale chic Hotel called Aiden by Best Western Hotel.

The APG group has a 20 year agreement with the AIDEN by Bestwestern for this location.

Best Western Hotels & Resorts, headquartered in Phoenix, Arizona, is a privately held hotel brand with a global network of approximately 4,700† hotels in over 100† countries and territories worldwide. Best Western offers 18 hotel brands to suit the needs of developers and guests in every market.

ARBT Property Group Pty Ltd has entered into an 5 year Exclusive Partner agreement/ with the Best Western Hotel group to develop their brands Executive Residency, Aiden by Best western and BW Premiere by Best Western. The exclusive arrangement allows the group to develop these brands and exclusively to operate in these cities.

The end result?

Investor friendly terms that provide upside potential from this round

If you decide to invest in Trade Facility and/or Development Fund through this private Regulation-A+ offering, you will be getting the same terms in this offering as the executive team – and other insiders close to the deal – who may also invest in this round.

Want To Invest In This Company?

Click the button below to get started...

A Popular Solution To An Urgent Problem

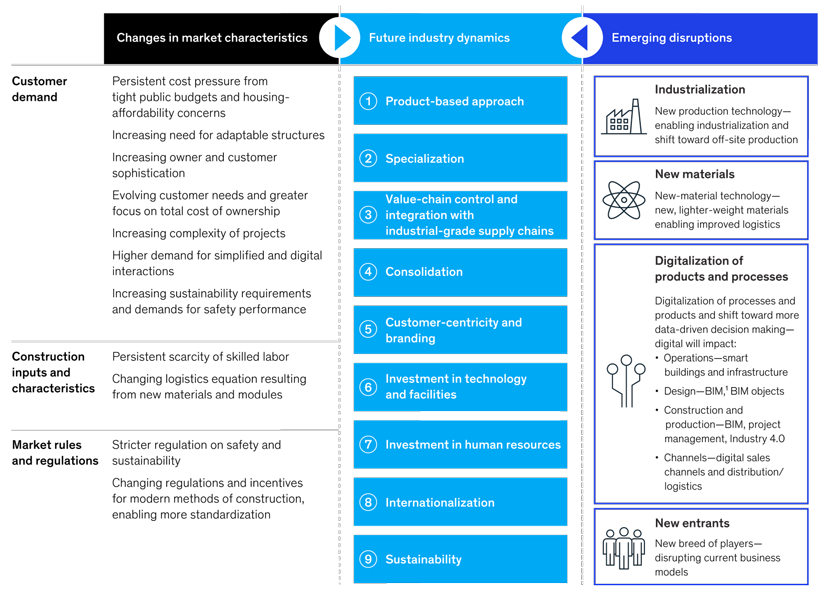

The next normal in construction How disruption is reshaping the world’s largest ecosystem.

A changing market environment, technological progress, and disruptive new entrants will trigger industry overhaul. The construction industry was already starting to experience an unprecedented rate of disruption before the COVID-19 pandemic. In the coming years, fundamental change is likely to be catalyzed by changes in market characteristics, such as scarcity of skilled labor, persistent cost pressure from infrastructure and affordable housing, stricter regulations on work-site sustainability and safety, and evolving sophistication and needs of customers and owners. Emerging disruptions, including industrialization and new materials, the digitalization of products and processes, and new entrants, will shape future dynamics in the industry (refer to Exhibit A).

Sources of disruption

Rising customer sophistication and total-cost-of-ownership (TCO) pressure

Customers and owners are increasingly sophisticated, and the industry has seen an influx of capital from more savvy customers. From 2014 to 2019, for example, private-equity firms raised more than $388 billion to fund infrastructure projects, including $100 billion in 2019 alone, a 24 percent increase from 2018. Client demands are also evolving regarding performance, TCO, and sustainability: smart buildings, energy and operational efficiency, and flexibility and adaptability of structures will become higher priorities. Expectations are also rising among customers, who want simple, digital interactions as well as more adaptable structures.

Exhibit A

Changing characteristics and emerging disruptions will drive change in the industry and transform ways of working.

The industry is facing persistent cost pressure because of tight public budgets and housing-affordability issues. McKinsey analysis found that $69.4 trillion in global infrastructure investment would be needed through 20353 to support expected GDP growth and that every third global urban household cannot afford a decent place to live at market prices.4 The economic fallout of the COVID-19 crisis magnifies the cost and affordability issues.

Industrialization

Modularization, off-site production automation, and on-site assembly automation will enable industrialization and an off-site, product-based approach. The shift toward a more controlled environment will be even more valuable as the COVID-19 pandemic further unfolds. The next step in the transition to efficient off-site manufacturing involves integrating automated production systems— essentially making construction more like automotive manufacturing.

“ We believe Housing units should be manufactured in a production line similar to automobile production to improve efficiency and affordability ”

New Materials

Innovations in traditional basic materials like cement enable a reduction of carbon footprints. Emerging lighter-weight materials, such as light-gauge steel frames and cross-laminated timber, can enable simpler factory production of modules. They will also change the logistics equation and allow longer-haul transport of materials and greater centralization.

Digitalization of products and processes

Digital technologies can enable better collaboration, greater control of the value chain, and a shift toward more data-driven decision making. These innovations will change the way companies approach operations, design, and construction as well as engage with partners. Smart buildings and infrastructure that integrate the Internet of Things (IoT) will increase data availability and enable more efficient operations as well as new business models, such as performance-based and collaborative contracting. Companies can improve efficiency and integrate the design phase with the rest of the value chain by using building-information modeling (BIM) to create a full three-dimensional model (a “digital twin”)—and add further layers like schedule and cost—early in the project rather than finishing design while construction is already underway. This will materially change risks and the sequence of decision making in construction projects and put traditional engineering, procurement, and construction (EPC) models into question. Automated parametric design and object libraries will transform engineering. Using digital tools can significantly improve on-site collaboration. And digital channels are spreading to construction, with the potential to transform interactions for buying and selling goods across the value chain. As in other industries, the COVID-19 pandemic is accelerating the integration of digital tools.

Want To Invest In This Company?

Click the button below to get started...

“ARBT Prefab Modular System”

And crazily enough, are able to complete a building in 120 days, design to delivery!

How do they do it? By engaging our own design to delivery team to implement the ARBT building system comprising of multiple modules connected with each other with our proprietary interlocking system that provides structural stability up to 40 stories.

And for investors who are looking for a way to play in the combined $24 Trillion Construction & Alternative Investments boom...

Housing affordability is one of the biggest problems to solve,and opportunites to measure the Environmental, Social & Economic impact of our investments...

But to have a proven, tested solution to do it in an economically viable way that can support a sustainable market… and potentially generate returns for investors!

Here’s why we do what we do...

Delivering Value to Developers, Investors and Home Buyers….What we call a Win-Win Solution

Patented ARBT Modular Prefab & Proprietary Interlocking Technology Is Ahead Of The Curve

Resulting in Faster, More Cost-Effective and Sustainable Buildings without compromising on the structural safety, stability and quality finished product.

In addition...

A State-Of-The-Art Manufaturing Facility To Produce At Scale

Our current factory is spread across 2 acres of land with a covered area of 50,000 Square feet in the Free Trade Zone in Malaysia.

Our current production capacity is about 960 modules per year, we are expanding this to a larger area within Malaysia and Singapore to about 3000 modules per year. All the steel frames are manufactured using Kuka Robots in our factory and the other processes like wall framing, sheeting, waterproofing, and tiling are all being automated.

By optimising the various construction processes and sequences our goal is to create a consistent and quality product that allows a faster construction with a reduced cost. As such, our goal is to set up and operate by 2025; a total of 5 factories across the globe with a presence in Malaysia, Singapore, Middle East, Australia, United States and Europe.

And with more demand means more opportunity to scale. How will they do it?

An Experienced Management Team With More Than $XYZ Million In Exits And Skin In The Game!

THE TEAM

The team at Centurion have specialised knowledge in establishing, implementing and managing a variety of registered and unregistered managed investment schemes investing in direct real property, mortgages, securities and other financial assets.

Our fund management team have had extensive experience in delivering a variety of investment funds on behalf of private and institutional investors, private companies and major corporations. Our core focus lies in our prudential property acquisition process, intensive asset management programmes, innovative value-adding strategies and stringent approach to risk management, corporate governance and compliance.

Michele Jackson

Responsible Manager - Compliance

Michele holds a Bachelor of Commerce in Accounting and Economics, is a Fellow Chartered Global Management Accountant (London) and Fellow CPA (Australia). Michele also holds a GradDip Financial Planning (Finsia) and a Certificate 1V in Property Services (Real Estate).

Michele has over 25 years international experience in the financial services industry with particular emphasis on fund management, banking, compliance and governance, finance, lending and advisory services. Michele is an experienced fund manager and has managed funds in excess of AUD $1.3 billion. Her passion is property, infrastructure, investment strategy and fundstructuring. Her advisory work includes working with international entrants into the Australian financial services regime.

Her technical and operational competence in managing funds in Australia as well as her wide national network is highly regarded by her clients.

Andrew Jackson

Responsible Manager - Compliance

Fellow of the Chartered Institute of Secretaries, London (FCIS) and Diploma of Financial Services (Financial Planning).

Andrew has many years senior executive management experience in all aspects of business but with particular emphasis on trustee management services, financial planning, fund management, lending and finance.

Andrew is an experienced business executive and has held Chief Executive positions in the private health care funding sector. He has consulted to large insurance companies and multinational pharmaceutical companies assisting them with their dealings with stakeholders including government and industry bodies whilst providing strategic marketing advice.

His leadership roles in fund management and financial services has given him responsibility for trustee services, compliance, sales and marketing,

operations and process including productivity, systems, finance and audit. Operations management includes multiple site operations in local and foreign markets.

Solomon Noel

Director Asset Management

A successful and accomplished business professional with over 20 years of business experience across IT, Property development, Finance and management. Extensive experience operating in highly competitive markets, both local and international markets. Currently overseeing a group turnover of over $50 million and total staff of over 150 within the group, holding directorships in Australia, Singapore and Malaysia. Solomon has a successful track record of raising capital, growing businesses, pursuing innovative ideas, pitching proposals, implementing key strategies, working with policy, governments, regulators and building relationships. Solomon is regarded as an astute leader whilst he has the proven capacity to provide leadership, execute a vision, execute the strategy, he is highly regarded in the management of the ongoing business operations.

Solomon holds a Bachelor of Multimedia, Cert IV in Property Services (Real Estate), an Advanced Diploma in Building and Construction Management and Diploma of Accounting. Solomon is RG 146 compliant and has completed various executive courses with the National University of Singapore in real estate finance, securitisation, investment and asset management. Solomon is licensed under the Queensland Building and Construction Commission as a Open Builder.

Kay Sharma

Director

Karishma (Kay) Sharma is an Australian finance executive with over 12 years’ experience in the commercial and financial management of public companies in Australia having held financial management roles in ASX listed investment and mining resource company (Ariadne Australia Limited and Ludowici Limited).

She has significant capabilities in development and property/construction as she has been the financial controller of a Queensland based construction company which has constructed over $37 million in property and has a further of $35 million projects in the pipeline. She holds tertiary qualifications in accounting and finance.

Manufacturing Facilities That Enable Aggressive Expansion Opportunities

Changing the way we build

Our current capacity is about 960 modules per year , & are expanding this to a larger area in Malaysia and Singapore to about 3000 modules per year. Our goal is to setup & operate by 2025, a total of 5 factories around the globe, with a presence in Malaysia, Singapore, Middle East, Australia, Unites states & Europe.

Our current factory is spread across 2 acres of land with a covered area of 50,000 square feet in the free trade zone in Malaysia.

Want To Invest In This Company?

Click the button below to get started...

A Clear Pathway To Multiple Exit Opportunities

| Security for Loan | Loan secured by second ranking mortgages over real property, various security deeds as well as corporate and personal guarantees. |

Track Record Projects

Through his group of companies, Solomon has developed and constructed numerous 'property developmentt' projects.

Solomon is developing the current project at 50 Carl Street projects as a Best Western Serviced Apartment Project – Executive Residency by Best Western, this project will be complete by July 2022.

These projects include:

| 2012 | Norman Park Properties – 8 Units ($3.7 million) |

| 2013 | Wynnum Investment Properties - 7 Units ($4 million) |

| 2015 | Mascar Property Investments – 14 Units ($5.6 million) |

| 2017 | Raffles Property Investments – 21 Units ($12.5 million) |

| 2019 | Ventura Investment Properties – 32 Units ($18 million) |

| 2020 | Carl Property Investments – 51 Units (in progress) ($46 million) |

1. Exit strategy

Subject to market conditions prevailing at the end of the Loan Period, the Borrower's exit strategies are to repay the Loan from the funds it will receive from the Developer.

In the event that the Borrower fails to repay the Loan when due, the Trustee may seek to sell the realise the assets the subject of the second registered mortgages.

The Borrower has entered into an agreement with the land owner to develop the site into a Best Western Hotel brand Aiden. The Borrower The Borrower requires the Loan in the form of a trade facility to fund the purchase of the Building Components that will go into the development. to sell them to the Developer.

Although The Developer will have a construction loan facility with a lender/bank within 12mthsBank, under usual facility terms under the terms of the construction loan facility, the Developer is unable to draw down the loan proceeds to pay for the Building Components at the time of delivery because under the terms of the construction loan facility, the Developer can only make progress claims when the work has reached a certain stage such as basement level etc the trade facility is the bridge for this..

Essentially, the Borrower is looking for a Loan to enable the funding of the timing difference before the Developer can seek reimbursement from the Lender/Bank under the construction loan facility.

Once the Developer obtains reimbursement from the Lender/Bank, the Developer will pay the builder for the building components which will give the Borrower the funds to repay the Fund and the investors.

2. Need for additional security over real property

The primary security for the Loan from the Borrower will be a general security agreement over all present and after acquired property of the Borrower, including the Building Components.

However, given the nature of this security, the Trustee has formed the view that additional security over real property is required.

Accordingly, the Trustee will be requiring additional security from the ARBT Group over real property, namely second registered mortgages. Security provided are; over:

- 44 Mascar Street, Mt Gravatt, Queensland (814 Apartments);

- 2939 Raffles Street, Mt Gravatt, Queensland (21 Apartments); and

- the Development Site address 33 Carl Street Woolloongabba Qld.

A “Double Dip” For Savvy Investors That Want To Generate 26% p.a Combined Returns By Diversifying In Both Our Trade Facility Fund & Our Development Fund (paid in Monthly distributions)

Want To Invest In This Company?

Click the button below to get started...

INVESTMENT DOCUMENTS, RISKS & DISCLOSURES

An investment in the Company involves a high degree of risk. You should carefully consider the risks described above and those below before deciding to purchase any securities in this offering. If any of these risks actually occurs, our business, financial condition or results of operations may suffer. As a result, you could lose part or all of your investment.